PROJECT SUMMARY

IN SUPPORT OF A LOAN REQUEST INVOLVING FUTURE PARTICIPATION IN RIVERSDALE INTERNATIONAL AIRPORT LTD, BELIZE (RIA) , AND OPTIONAL REAL ESTATE INVESTMENTS.

Prepared for JR Richardson, care of, Dr. Atul Gupta

Section 1: Overview

Through his relationship with the ownership group of the already partially constructed RIVERSDALE INTERNATIONAL AIRPORT, in Belize, Central America (“RIA”), Dr. Atul Gupta (Gupta) has been granted the right to facilitate the next capital raise required for the continued development of RIA, which is located near Placencia, Belize, and is being developed in conjunction with multiple real estate projects in the Placencia area over the next several years.

The Airport has a 9,200 feet long x 200 feet wide runway, with the proper deep concrete footings that can handle large international passenger and cargo planes, and is located on 415 acres of land (the “Airport Lands”). The Airport lands are owned on a freehold basis by the Airport ownership group, including all airport assets. As the existing runway’s concrete surface has not yet been finished with an asphalt top layer, the runway has only been used by private planes over the past decade. There are also several small buildings, and one main terminal building that is under construction at RIA, that form part of the Airport’s assets.

The immediate goal of Gupta is to supply RIA with the $6,000,000 USD necessary for laying down the final asphalt surface of the runway, while the Airport ownership group is aggregating the additional funds that will subsequently be used for capital expenditures to complete the terminal buildings (including furnishings and equipment for an approximately 20,000 square foot terminal building), expand the aprons, build the fire and ambulance infrastructure (including the procurement of all fire and ambulance equipment), working capital purposes, baggage handling and security equipment, and development fees.

Gupta has already contributed $800,000 USD of his own capital towards the $6,000,000 USD asphalt surfacing cost, and is inviting one or more participants of his choosing to participate in raising the remaining $5,200,000 USD, preferably by way of a short term loan that later converts to an equity position in RIA (the “Airport Rollover” as further described in Section 9)

Incentives and benefits for Gupta (and his chosen capital partner(s) or lender) to raise the $6,000,000 USD for the asphalt surfacing of RIA are highly valuable, and include Preferred Share Pricing for Airport buy-in, and more importantly, immunity from future dilution of shares, regardless of additional capital raises made by RIA for future expansion.

Section 2: Feasibility and Future Performance of the Airport

Being an investor in RIA would provide for a profit sharing participation in the cashflow generated by operations of the Airport. Structuring of the cashflow in the first few years would favor the investor’s return, allowing for a cash on cash break-even sooner than otherwise would be delivered on a pro rata basis. There is no debt on the Airport Assets, nor does management expect to have any debt through the initial years of operations, and thus there will be no financial handicaps to mitigate performance potential of the Airport.

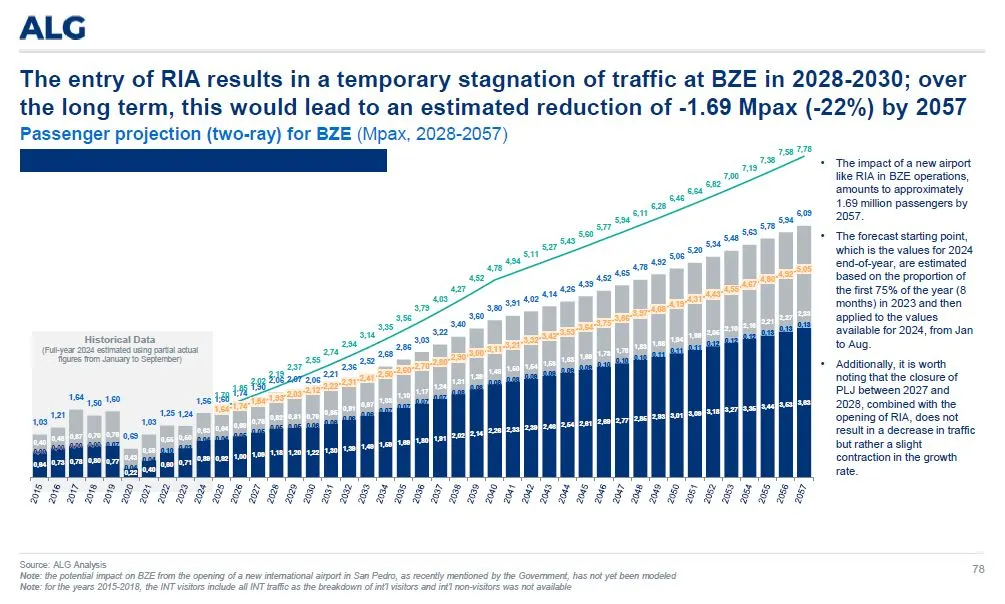

A conservative and extremely comprehensive technical advisory/traffic forecast/business plan (which was prepared by ALG, a globally recognized expert in forecasting viability of international airports) can be reviewed by clicking here, but we recommend waiting until after reviewing this Project Summary in its entirety as key extracts from the ALG report will be featured here.

Participation in RIA also grants Gupta and his chosen capital partner(s) first right of refusal to invest in the development of various existing and future real estate projects in the Placencia region. The principals of the Airport ownership group are also the owners of the Placencia Hotel (which recently became the first hotel in the country that will be branded by Hyatt Hotels), along with an adjacent, and already partially constructed condominium tower development known as Copal (which boasts a Casino License, and the only deepwater/large yacht marina in the area), as well as 2,500 acres of adjacent lands to the Airport Lands, where a new exclusive golf course development will be built (which will include 1500 luxury homes, many of which will be waterfront), and all of which will benefit from not only the forthcoming opening of the Airport, but also the upward trending economy of the country. (see Section 3)

Section 3: Economy of Belize

Belize, a small nation on the northeastern coast of Central America, boasts an economy characterized by its focus on tourism, agriculture, and, to a lesser extent, manufacturing and services. With a GDP of approximately $3.0 billion in 2023, Belize's economic landscape is shaped by both its natural resources and its strategic geographical position, which provides access to major markets like the United States and Mexico.

Tourism is the primary driver of Belize's economy, contributing significantly to foreign exchange earnings. The country's rich biodiversity, including the Belize Barrier Reef, the second-largest barrier reef in the world, and numerous Mayan archaeological sites, attracts a steady flow of international visitors. In 2023, tourist arrivals totaled about 428,000, with receipts amounting to $450 million, directly contributing 15.0% to GDP and indirectly up to 33% when considering broader economic impacts like investment, supply chain, and induced income effects. Direct tourism employment is about 13% of total employment in the country.

Agriculture remains a key sector, with traditional exports like sugarcane, citrus, bananas, and marine products forming the backbone of the economy. Belize has about 8,090 km² of arable land, but only a small fraction is under cultivation. Sugarcane is particularly significant, with Belize producing more than 200,000 metric tonnes annually. Other crops like citrus and bananas also play crucial roles in export earnings. The agricultural sector has seen diversification over the years, moving away from a heavy reliance on timber, which was once the primary economic activity. The decline in logging due to deforestation and market fluctuations has led to a shift towards agro-products.

Manufacturing in Belize is somewhat limited due to high energy costs and a small domestic market. However, there are niches like apparel manufacturing where Belize has made inroads. The country also offers incentives to attract foreign direct investment (FDI), particularly in tourism, energy, telecommunications, and agriculture. Belize operates as a tax haven, providing benefits to international business companies (IBCs), which supports its financial services sector. The IBC Act of 1990 exempts offshore companies from all taxes, encouraging international incorporation.

The Belizean dollar is pegged to the U.S. dollar at a rate of 2:1, which helps maintain economic stability, and inflation has been relatively controlled, with an average of 1.3% the past decade.

The government of Belize has been actively pursuing economic stability and growth through fiscal reforms and debt management. Public debt had previously been a concern, with efforts in recent years to reduce it from unsustainable levels through restructuring, including a significant debt-for-nature swap with The Nature Conservancy in 2021, aimed at marine conservation while reducing debt. By 2023, public debt was reduced to 66.3% of GDP from a peak of 132% in 2020.

Belize's economic growth has been subject to rapid change, with a strong rebound post-COVID, and with projections of moderating growth rates as the tourism sector stabilizes. Unemployment rates have seen dramatic improvements, dropping from 14% in 2020 to 3.4% in 2023, reflecting a robust recovery in employment opportunities, particularly in tourism sectors.

In summary, Belize's economy is on a path of cautious optimism, with tourism and agriculture as the dual pillars supporting growth. The focus on sustainable practices, investment attraction through tax benefits, and careful fiscal management are pivotal to navigating the challenges of global economic dynamics and local constraints. However, the ongoing need for infrastructure development, continued responsible management of public debt, and further efforts to raise the country’s profile as a top tourist destination (Section 4), will remain of paramount importance.

The opening of RIA will have a significant impact on the realization of both the country’s goals of continuing to grow the economy, and the profitability of the various real estate projects being developed by the Airport ownership group in conjunction with the completion of RIA.

Section 4: Tourism as the Economic Backbone of the Country of Belize

Tourism is a significant economic contributor to Belize's economy. It ranks as the number one foreign exchange earner for the country, surpassing other key sectors like agriculture and marine products. According to data, in 2023, tourism directly contributed 15.0% to the total GDP of Belize, with a total economic contribution accounting for 41.3% of GDP. This sector not only brings in substantial revenue, but also supports employment, directly accounting for 15% of total employment (21,000 jobs) in the same year, with the total employment impact, including indirect jobs, reaching 37.3% of total employment (59,000 jobs). The growth in tourism has also positively affected related industries such as agriculture, commercial activities, finance, and construction, further underlining its role in economic development.

The allure of Belize's natural attractions like the Barrier Reef, numerous offshore cayes, and historical Maya ruins, alongside its strategic location close to the United States, makes it particularly attractive for American tourists and retirees, who constitute a significant portion of the visitor demographic. This has led to a focus on expanding overnight opportunities for high end travelers, and the development of luxury accommodations by international hotel chains. Belize's tourism sector has shown resilience and growth, with a reported record-breaking number of tourist arrivals in 2024, indicating both a sustained and increasing economic impact from tourism in recent years.

Post the global economic downturn due to the COVID-19 pandemic, Belize's tourism sector has shown a remarkable recovery. By 2024, Belize recorded a 21% increase in overnight visitors compared to 2023, surpassing pre-pandemic numbers from 2019 by 11.8%. This resurgence has led to an economic boom, with tourism (both direct and indirect), projected to generate $1.4 billion in revenue for 2025, highlighting its pivotal role in economic recovery and growth. The growth in tourism has had a ripple effect across various sectors, such as:

- Development of new hotels and resorts, particularly aimed at luxury travelers, have stimulated the construction sector.

- Agricultural Exports, through increased demand from tourists for local produce, has boosted agricultural exports, notably sugarcane and citrus.

- Business Process Outsourcing where tourism has indirectly supported the expansion of the BPO sector, now representing 10% of employment, contributing to economic diversification.

- Sustainable Tourism where Belize is leveraging its natural assets like the Belize Barrier Reef and its rich biodiversity towards sustainable tourism, recognized globally with awards like the Leading Sustainable Destination at the World Sustainable Travel and Hospitality Awards in 2024. This focus not only preserves the environment, but also ensures long-term economic benefits from tourism by attracting eco-conscious tourists.

- Infrastructure Development through the increase in tourist arrivals has necessitated improvements in infrastructure, particularly in air transport, with new direct international flights, and with ongoing work taking place at the Philip Goldson International Airport to handle this increased traffic. This not only supports tourism, but also enhances Belize's connectivity, thus drawing even more investment and tourists.

Tourism has significantly influenced GDP growth, with significant increase realized in 2024, attributed mainly to the tourism boom. This sector has been a primary driver behind Belize's economic performance, contributing to a GDP increase, and lowering unemployment to an all-time low of 3% in 2024.

While tourism drives economic growth, it also necessitates an added focus on environmental sustainability, the need for infrastructure to match tourist influx, and ensuring the benefits are distributed equitably among Belizeans. Future opportunities include further capitalizing on eco tourism, cultural tourism, and leveraging Belize's strategic location for trade finance and nearshoring, which could further diversify and strengthen the economy. Thus, tourism in Belize is not just an economic contributor but a cornerstone of its economic strategy, influencing job creation, infrastructure development, and national income, while promoting sustainable practices.

Section 5: Tourism as the Economic Backbone of Placencia, Belize

Tourism is the cornerstone of Placencia’s economy. The region boasts some of the most beautiful beaches in Belize, coupled with proximity to the Belize Barrier Reef, which is a UNESCO World Heritage Site, making it a prime destination for tourists interested in water-based activities like snorkeling, diving, island excursions, and sport fishing/fly fishing.

Tourism significantly contributes to the local economy through direct spending on accommodations, dining, tours, and local goods. According to recent data, tourism in Placencia contributes around 30% to the local GDP, with substantial employment opportunities in hospitality, tour guiding, and related services. The tourism sector in Placencia is currently highly seasonal, with peak seasons during the dry months from December to April. However, efforts are being made to promote year-round tourism by diversifying activities and promoting cultural and eco tourism, and the opening of RIA will draw the European tourists, which is expected to significantly increase tourism in the summer months.

Increased tourism to Placencia has also triggered a surge in real estate development, particularly aimed at expatriates and retirees from North America. Properties range from luxury beachfront villas to modest homes, driving up property values and stimulating the construction sector.

Placencia is marketed as an ideal retirement destination, which has led to an influx of foreign investment in real estate, further bolstering the local economy. This demographic also contributes to the local economy through long-term residency, spending, and community involvement. (Examples of online articles highlighting Placencia can be found here).

The increase in tourism has also led to a boom in local businesses, from cafes and restaurants to tour operators and souvenir shops. The extended stay of tourists and expatriates has created a demand for services like health care, education, and entertainment. There's a direct correlation between tourism growth and employment, providing jobs not only in hospitality but also in ancillary services like transportation, retail, and construction.

The completion and opening of RIA is expected to have a profound economic impact by increasing the wage rate for all direct employees, as well as the standard of living for affected families, not to mention the increase in tourist influx, reducing travel time, and enhancing logistics for goods and services.

New infrastructure typically leads to real estate appreciation and business opportunities. Investors in hotels, resorts, and other services around the new airport could see substantial returns as tourism grows. Over time, this infrastructure could lead to broader economic benefits, including better distribution of tourist dollars across Belize, improved logistics for goods transport, and possibly serving as an emergency backup for the primary airport.

A second international airport in Belize presents a strategic opportunity to enhance the nation's tourism and economic landscape. By leveraging the growing international interest in Belize, RIA is well positioned to yield significant returns for investors, promote regional development, and advance Belize’s goals of becoming a more dominant player in the global tourism market.

In summary, Placencia's economy is predominantly driven by tourism, with real estate, fishing, and agriculture playing supporting roles. The region's future economic health will depend on sustainable tourism practices, infrastructure development, and maintaining the balance between growth, and preserving its cultural and natural heritage, and Placencia and the surrounding area will benefit immensely from an emerging focus on, and dedication to, eco-tourism going forward.

Section 6: Imminent Real Estate Explosion in Placencia

In the past several years there has been the advent of what is being described as "a movement" whereby millions of Americans have decided that they want to relocate to the Caribbean in the near future, (or at least establish a second home in the Caribbean) and Belize in general, (and Placencia in particular), stands to be an outsized beneficiary of this movement, due to a combination of factors that in aggregate, are effectively exclusive to Belize, and extremely attractive to Americans.

These factors include the fact that Belize is the only English speaking country in Central America, and has the benefit of real estate purchasers being able to acquire true fee simple deed and title, which allows for full foreign ownership of property. (Foreigners can own property outright, with the same rights and benefits as local Belizean Citizens, whereas most other countries place significant restrictions on foreign property buyers, and/or subject the “purchaser” to only having a land lease, as opposed to outright ownership).

Belize also has the benefit of being a stable democracy, that operates under British Common Law, (the only mainland Central American country that is a Commonwealth realm) and has the additional advantage (along with Guyana and Suriname in South America) of being the only Member Countries of the Caribbean Community and Common Market (CARICOM), that are on the mainland. Additional appealing factors for retirees to move to Belize is that it has been rated #2 on the list of "Top Tax Friendly Options" for American retirees, and unlike European retirement destinations, retirees get the benefit of knowing they could hop a plane to go see their grandchildren stateside, and arrive there in only a few hours.

With plenty of undeveloped land to facilitate new construction of homes per the purchasers specifications, and all of the above listed factors, Placencia is poised to be one of the preferred landing spots for the growing exodus of disenfranchised Americans.

Section 7: The Aviation Sector in Belize

The aviation sector in Belize is primarily regulated by the Belize Department of Civil Aviation (BDCA), established under the Civil Aviation Act, Chapter 239, Revised Edition 2000. Its principal function is to ensure the safety, efficiency, and economic development of civil aviation while adhering to international standards set by the International Civil Aviation Organization (ICAO).

Philip S. W. Goldson International Airport (BZE/MZBZ) is the main international airport, located in Ladyville, about 10 miles from Belize City. It handles all international traffic, with a 9,750 foot runway that accommodates large aircraft. This airport has been pivotal for tourism, with connections to major cities in the United States, Canada, Mexico, and Central America.

There are several smaller domestic airports like the Sir Barry Bowen Municipal Airport in Belize City, serving local routes, particularly to the popular tourist islands like Ambergris Caye and Caye Caulker, facilitating both tourism and local transport.

Tropic Air and Maya Island Air are the primary domestic carriers, providing service to various destinations within Belize and some regional flights to neighboring countries like Guatemala, Mexico, and Honduras. These airlines operate with smaller aircraft, Cessna Grand Caravan, suitable for short domestic flights.

Several international carriers operate from Belize, including American Airlines, Copa Airlines, Delta, Southwest Airlines, United, Alaskan, Westjet and others, offering direct flights to major cities in North America and within Central America.

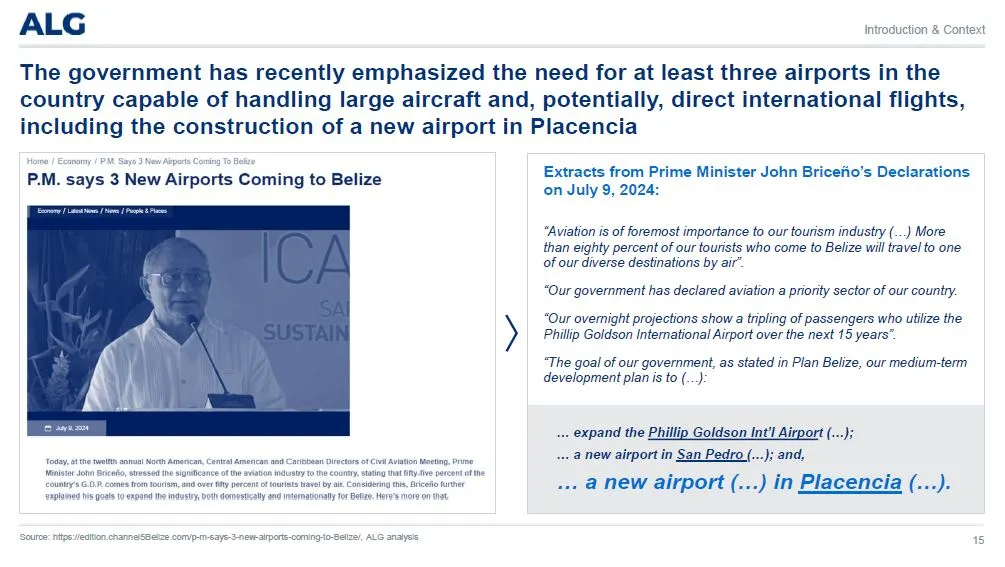

The BDCA oversees all aspects of civil aviation, including air traffic services, licensing, safety oversight, and security. They ensure compliance with ICAO standards, manage air traffic control, aerodromes, and handle aeronautical information services. Recent developments include plans for expansion of tourist capacity with the construction of new airports in key tourist areas like San Pedro and Placencia (RIA) to accommodate larger planes and increase regional connectivity.

The Belize Defence Force Air Wing operates from the Philip S. W. Goldson International Airport, focusing on reconnaissance, search and rescue, medical evacuation, and drug interdiction. They have historically used various aircraft types, including Briien-Norman Defenders and UH-1H helicopters donated by Taiwan.

Aviation in Belize is crucial for the tourism industry, which accounts for a significant portion of the GDP. The sector's growth is directly linked to the expansion of tourism, with projections to triple overnight arrivals in the next 15 years, necessitating further developments in aviation infrastructure.

Challenges include the management of low-lying areas prone to flooding, like the Philip S. W. Goldson International Airport, and the need for more robust infrastructure to support growing tourism demands. Recent initiatives include the acquisition of primary radar to enhance air navigation and safety.

Overall, Belize's aviation sector is geared towards supporting its thriving tourism industry while ensuring compliance with international aviation standards.

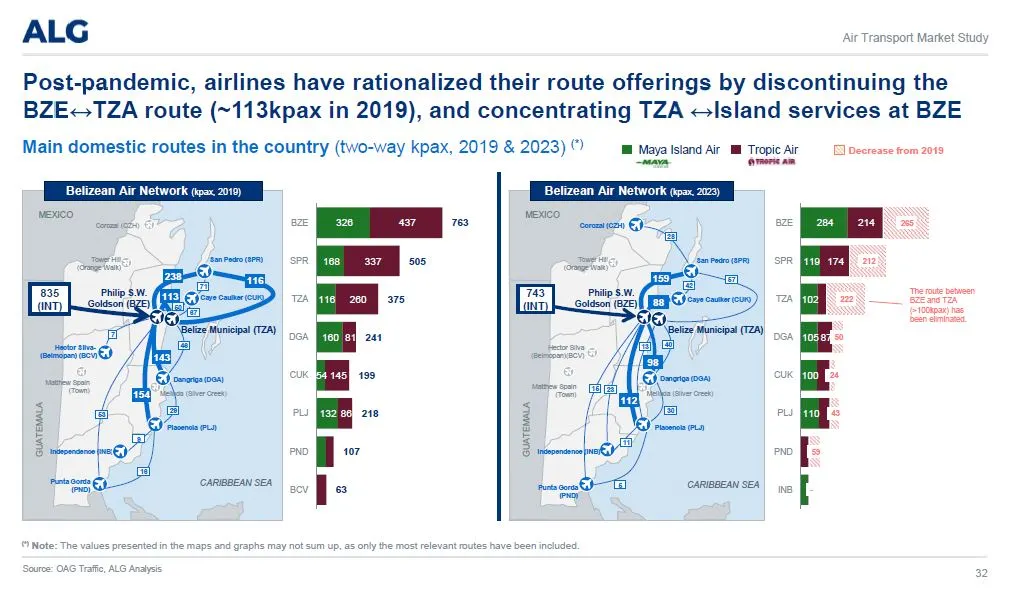

In 2023, the Philip S. W. Goldson International Airport (PGIA) in Belize saw significant passenger traffic. Approximately 890,000 passengers used the airport for international travel and 630,000 passengers for domestic travel. Seat capacity in 2024 was 1.26 million and 1.06 million for international and domestic travel, respectively.

This data reflects the airport's critical role in the country's tourism and local transportation sectors, serving as the primary gateway for international visitors and a hub for domestic travel within Belize. The stable growth in passenger numbers positions BZE/PGIA as one of the busier airports in Central America, consistently ranking as one of the busiest in the region.

Domestic aviation in Belize plays a pivotal role in connecting various parts of the country, particularly due to its geographical layout featuring numerous islands, remote areas, and challenging road networks during certain seasons. Here's an overview based on available information:

Tropic Air and Maya Island Air are the two main domestic carriers where Tropic Air provides flights to numerous destinations including San Pedro (Ambergris Caye), Caye Caulker, Placencia, Dangriga, Corozal, Orange Walk, Belmopan, Punta Gorda, and Maya Flats (near San Ignacio). They also offer flights to regional destinations outside Belize like Cancun, Roatan, and Flores.

Maya Island Air similarly services key locations within Belize such as San Pedro, Caye Caulker, Dangriga, Placencia, Corozal, Punta Gorda, and others, focusing predominantly on domestic routes. Philip S. W. Goldson International Airport (BZE) is the primary international gateway but also a major hub for domestic flights. Both Tropic Air and Maya Island Air have check-in counters at BZE for seamless transfers.

The Belize Municipal Airport (TZA) in Belize City serves as another domestic hub, offering connections to various inland and coastal destinations.

Other Domestic Airports include:

- San Pedro Airport on Ambergris Caye

- Caye Caulker Airport

- Placencia Airport

- Dangriga Airport

- Corozal Airport

- Punta Gorda Airport

- Maya Flats Airstrip near San Ignacio for access to the Cayo District Orange Walk Airport

These airports and airstrips are strategically located to serve both tourist destinations and local communities, facilitating travel during times when road travel might be less viable due to weather or terrain.

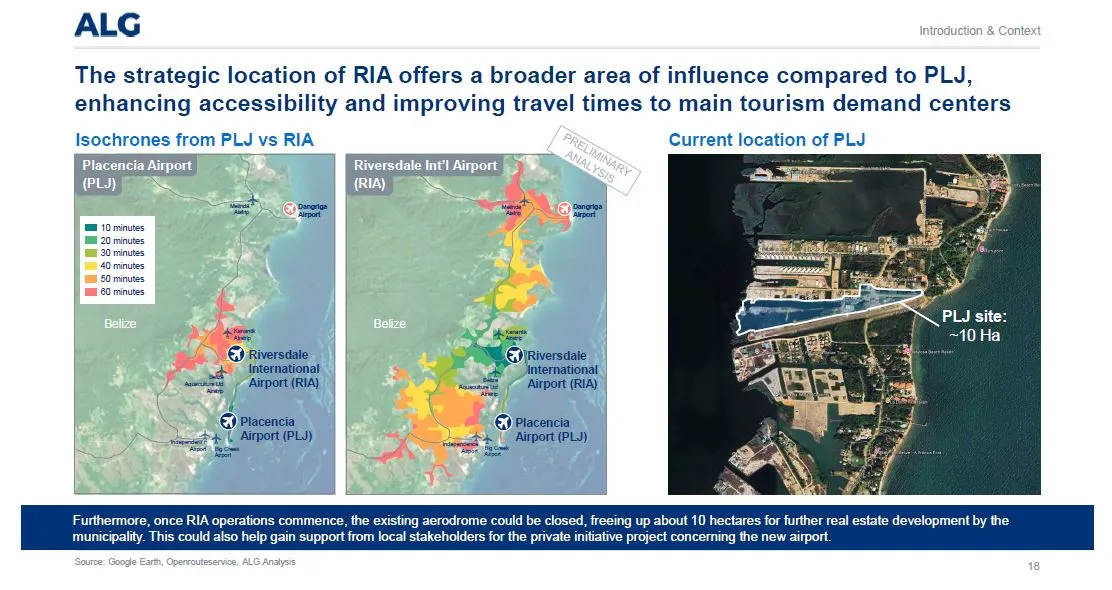

Air Traffic into Placencia

Currently, there is a small airport on the peninsula of Placencia, (PLJ), that has a 2600 feet runway, which can accommodate light single engine aircraft. This smaller airport handles approximately 215,000 passengers per year which arrive mainly from Belize City, BZE. Once the asphalt surfacing of the runway of RIA is completed, it is anticipated that the traffic from PLJ will migrate over to RIA, as it is nearer to all other points of aeronautical origin, is much safer, and is less stressful on the plane and passengers.

This volume of passengers is anticipated to increase significantly with the opening of RIA, as more tourists will be willing to choose Placencia as their vacation destination if getting there can be simplified and expedited by eliminating the need to take a second domestic flight, after arriving on their initial international flight.

The Belize Department of Civil Aviation (BDCA) oversees all domestic aviation activities, ensuring safety and regulatory compliance in line with international standards. Pilots must obtain clearances for domestic flights at the Belize AIS/ARO Office at PGIA, carrying specific documentation like the Aircraft Clearance Certificate.

Domestic flights are crucial for tourism, allowing tourists to explore Belize's varied attractions efficiently. They also support the local economy by enabling quick access to different parts of the country for both residents and visitors, enhancing business travel and the transport of goods in some instances.

Here's an overview of the future growth forecast for both international and domestic aviation in Belize based on recent trends and analyses:

International Aviation

Belize has been experiencing a notable increase in international air connectivity, positioning itself as a growing destination in Latin America's airline market. There has been a significant boost in international flights, particularly from North American carriers like American Airlines, United Airlines, Alaskan, Southwest, and Delta, offering direct services to key U.S. cities such as Miami, Houston, Dallas, Los Angeles and Atlanta, among others. Seasonal routes from Canadian airlines like WestJet and Air Canada also enhance accessibility during peak tourist seasons.

The expansion in international routes directly correlates with Belize's tourism growth. With its diverse attractions including diving spots, Mayan ruins, world class fishing, and cultural experiences, Belize's appeal is expected to continue driving demand for international flights. This focus on improving air connectivity is part of a broader strategy to make Belize more accessible to global tourists.

While specific long-term growth figures for Belize alone are not detailed in global forecasts, the region's trajectory suggests continued growth. Latin America's commercial aviation sector is expected to grow, with Belize benefiting from this trend. The International Air Transport Association (IATA) and other industry analyses predict a general increase in traffic, although exact numbers for Belize would depend on local economic factors and tourism trends.

Domestic Aviation

Domestic aviation in Belize is already crucial due to the country's geography, with Cessna Grand Caravans servicing remote areas, islands, and key tourist destinations. In addition to our Airport ownership group preparing to open RIA in the near future, the Belizean government has additional plans for enhancing domestic infrastructure, which might include upgrading existing airstrips, or building new ones, particularly in tourist-heavy areas like San Pedro. The preferred focus for aviation improvements would be accommodating larger aircraft, although San Pedro will be limited to a 4,000 foot runway with more frequent flights to meet the growing demand.

Domestic air travel is expected to see steady growth, driven by both tourism and the need for efficient internal connectivity. The trend of expanding domestic routes aligns with the global increase in regional air travel demand. Forecasts for international aviation into the Placencia region suggests a CAGR of around 3.7% for the 30 years, which could be indicative of Belize's domestic market, given its reliance on aviation for internal transport.

PLJ Recent Airport Performance

Passenger count at the local airport in Placencia (PLJ) is estimated will be approximately 230,000 passengers this year. The expectation is that all PLJ planes and passengers will shift to RIA since it is 15 miles closer each way (therefore less fuel consumption), and the RIA runway is more than 3 times the length of the PLJ runway, so landings are much easier on the aircraft’s brakes, with no risk of ending up in the lagoon. We are confident that the passenger count of the RIA airport will exceed the ALG traffic estimates in the first five years, as RIA and will attract many larger international carriers to fly direct to Placencia. The growth in hotel rooms over the next 10 years is estimated to be more than 500 additional rooms by just the management team’s owned properties, (let alone any further development by other hotel operators), and this, coupled with the current rate of tourism growth in Belize of 24% year over year, will augment RIA’s ability to attract a significant influx of new international passengers visiting Placencia.

Belize's economic growth, which has shown resilience post-COVID, supports the aviation sector's expansion. With GDP growth rates fluctuating but generally positive, there's an underlying economic support for aviation, though exact forecasts for aviation growth directly tied to GDP are not publicly specified for Belize. (A detailed traffic forecast for RIA can be found on page 68 of the ALG Report)

In summary, Belize's aviation sectors, both international and domestic, are poised for growth, driven by tourism, economic development, and strategic improvements in connectivity, and the Airport ownership group of RIA is committed to balancing this growth with sustainable practices, and regulatory compliance, to maintain its appeal and operational integrity.

Environmental Impact Analysis for RIA

The construction and operation of RIA in Placencia has been approved with an Environmental license to proceed with construction. Since Placencia is close to mangrove forests and coastal wetlands, as well as critical ecosystems for marine life, including species like manatees and various fish, construction has been carefully conducted to minimize loss or degradation.

Increased air traffic will inevitably lead to higher emissions of CO2, NOx, and other pollutants, thus potentially impacting local air quality and contributing to climate change, though all within acceptable levels.

The noise from takeoffs, landings, and general airport operations has been studied and shown to be well within 55-60 DB for traffic up to 1.0 million passengers per year.

Drainage at the site has been analyzed, and engineered drainage patterns will be implemented for passenger and aircraft safety.

Government Approvals

The Government of Belize has issued a clean environmental assessment on the Airport Lands and issued a Letter of Support from the Ministry of Economic Development, Petroleum, Investment, Trade and Commerce. The Airport ownership group is currently negotiating with the Government heads to finalize operational terms. The Operating license will be issued once the capex is completed, and test flights have begun by commercial and passenger carriers.

RIA has broad freehold rights to collect revenue from commercial sources related to RIA airport operations, including landing fees, passenger fees, airline and gate fees, fuel sales, parking, food & beverage, and retail concessions. RIA will also have the right to charge and collect fees on advertising, sponsorship, telecommunications, vehicle charging, etc.

Section 8: Short Term Loan as a Precursor to Participation in RIA

As referenced in Section 1, the goal of Gupta is to arrange a Short Term Loan (STL) in the amount of $5,200,000 USD to fulfill his commitments to the Airport ownership group.

The envisioned STL structure would mirror conventional bridge loan models, with a bullet point overview looking like this:

Loan Amount: $5,200,000 USD

Loan Term: 6 months, with borrower option to extend to 12 months.

Loan Rate: Interest calculated based on 8% per annum.

Loan Security: Asset portfolio supplied by Airport ownership group.

Interest Servicing: Accruing for the loan term, with balloon payment end of term.

Payment Method: By way of RIA equity instead of cash.

Additional Lender Incentive: Preferred pricing and terms on equity participation.

Full details of the Loan Security will be provided upon request, and details of Payment Method and Lender Incentives can be found in Section 9.

Section 9: Airport Rollover

As referenced in Section 2, the Airport ownership group is seeking to avoid saddling RIA with debt in its infancy stages, and prefers that all individuals that contribute capital to the ongoing construction of RIA are instead motivated to become an equity participant in the Airport.

That being said though, the progression of RIA is such that completing the asphalt surfacing on the existing runway will serve as the catalyst to facilitating the raise of the balance of the capital required for full completion of the Airport, and RIA has a simultaneous opportunity to realize a substantial savings on the costs of the asphalt surfacing if effected in the coming months.

As such, this capital expenditure of laying the asphalt surface on the existing runway will predate the final corporate structure of the Airport ownership being in place, thus necessitating the facilitation of an STL component of the overall capital stack.

Upon such time as the RIA corporate structure has been finalized, the provider of the STL will be enabled to “roll-over” the original principal amount of the loan (plus the accrued interest amount calculated from the date of funding of the $5,200,000 USD, to the date that the Lender received “repayment” of the loan) and the form of rollover/repayment will be by way of the Lender being issued the proportionate amount of equity in RIA that could have been purchased with the cash amount that the Lender would otherwise have received as repayment.

A projection of what the above would look like is this:

-Mr. Richardson provides the $5,200,000 USD bridge loan to fund the asphalt surfacing of the existing runway as of July 15th, 2025. -Collateral deemed satisfactory to Mr. Richardson is contemporaneously put in place to secure the loan.

-The asphalt surfacing takes place over the ensuing 6 months, and in that time frame, the process of arriving at the final corporate structure for RIA is completed.

-Expectations are that the aforementioned structure will end up being such that a US based LLC will own the Belizean company that holds the Title to the underlying lands on which the Airport is being constructed, along with said LLC owning all intellectual property associated with Airport.

-Six months of interest would have generated $208,000 USD on top of the original capital of $5,200,000 USD for a total amount of $5,408,000 that would be “spent” on acquiring Membership Interests in the LLC.

-Additional Lender Incentives referenced in Section 8 apply to the metrics of the Membership Interests allocation, such that 3% of the Membership Interests of the LLC would be transferred to Mr. Richardson. (Whereas subsequent participants in RIA would receive significantly less Membership Interests for a future cash buy-in of $5.5M)

-An Operating Agreement for the LLC will be provided reflecting that Mr. Richardson’s Membership Interests in the LLC will be immune from any future dilution.

-Collateral is released contemporaneously with Mr. Richardson receiving his Membership Interests in the LLC, and the corresponding Operating Agreement has been effected.

Financial benefits of being a holder of Membership Interests in the LLC are vastly superior to most conventional investment opportunities, and of particular appeal to investors in the Airport is that the yield can easily surpass 20% just at base level (although the “true” yield is exponentially higher when one factors in that the investors are able to pull out their original capital within the first few years, yet still collect the annual returns thereafter) and that these returns are projected to continue to be realized year after year for upwards of 50 years (thus creating attractive opportunities for domiciling one’s participation in a family trust that generates income streams for future generations of the investor’s family), and a detailed breakdown of the yield (with corresponding projections) will be provided upon request. Payout in cash can be negotiated if Mr. Richardson does not like the RIA rollover option.

Section 10: First Right of Refusal on Real Estate Participation

An additional opportunity to realize financial gain from the birth of RIA lies in being a stakeholder in real estate situated in proximity to the Airport.

The provider of the STL referenced in Section 8 will be granted first right of refusal to participate as an investor in either or both of the two different real estate development projects being undertaken by the principals of the current Airport ownership group.

An Executive Summary that would enable review and analysis of each of these 2 opportunities can be provided upon request, but an initial visual introduction to the already partially completed Copal development can be found here.

Limited existing inventory prompted the roll out of a multi-owner approach to the current sales approach for the already completed units, but the majority of sales going forward are expected to be whole ownership sales of the condominiums that will be built in the remaining towers (in conjunction with the completion of other components of Copal such as the marina, casino, and future shopping village).

The other development project, (Panther Properties) is still currently in land planning stage, but will consist of a 1500 home master planned community situated between water frontage to the east of the residences, and a golf course bordering the west side of the community, and there are plans in the works for an island component with overwater bungalows, and a separate model geared towards the concept of private jet owners being desirous of having luxury vacation homes in proximity to tropical location airports with an FBO, and corresponding easy access to their vacation home… this is a new concept which is already being tested on the island of Barbuda.

More information regarding all of the above can be provided upon request, and we thank you for the opportunity to present this summary and proposal to you.